Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a business analyst who has a $170,000 joint income and who spends some of her money this week on Kurtis Conner comedy show tickets.

If you’d like to submit your own Money Diary, you can do so via our online form. We pay $150 for each published diary. Apologies but we’re not able to reply to every email.

Occupation: Business analyst

Industry: Oil and gas

Age: 28

Location: Houston, TX

Salary: $90,000

Joint Income & Finances Setup: $170,000 ($90,000 from me and $80,000 from my husband, P.). I just started my job about a month ago. Prior to that, I was on a break for about three years to work on my mental health. During that time, P. supported the family solely on his income. However, now that I have a job again, we split the finances 50/50 (if it seems like P. pays more monthly that’s only because I pick up the tab on other occasions like when we eat out or get coffee, which is a lot). Currently, this is what works for us, but if that ever changes, then we will adjust our finances.

Assets: We purchased our home in 2020 when the interest rate was incredibly low because of COVID-19 (they practically gave us the house). The current value of the home is $400,000, and we purchased it at $330,000. We put 5% down and have an interest rate of 2.5%. Currently, we own approximately 20% of the home while the bank owns the rest. We each own our own cars which in total value about $8,000; they are both old cars that have a lot of mileage on them, but at the very least, we don’t have to make any car payments. My car itself is only worth $1,000 in the market. I’ve had it since I was in high school at 17, so I have a lot of sentimental attachment to the car. I do want to purchase a new car in 2026 or 2027 depending on how we are financially. Neither of us have any savings or retirement savings (we’re really living on the edge here).

Debt: $7,000 owed to parents (saved me from racking up that much in credit card debt). My parents saved me from going into further credit card debit while I was on my personal health break. During this time, I depleted all my savings and retirement accounts and went into credit card debt. However, I was fortunate enough to have parents that were willing to bail me out.

Paycheck Amount (Biweekly): $2,800

Pronouns: She/her

Monthly Expenses

Housing Costs: Our mortgage is $2,000 per month which we split evenly between the two of us. Currently, my younger brother lives with us while he is attending university, but we do not charge him rent. We would only charge him rent if he had a full-time job, but he plans to move back in with my parents once he does find a job. Additionally, there is a high property tax that we pay annually, approximately 5% of our home’s value. This is lumped into our escrow, but will be moved out soon due to the fact that we own 20% of our home. So in the upcoming year, 2026, I expect to pay a high property tax bill with a lowered overall mortgage.

Loan Payments: $1,000 to my parents.

HOA: $142

Car Insurance: $42

Electricity: P. pays approximately $200 (depending on the month).

Water: $0 (lumped in with our HOA).

Internet: P. pays $150.

Gas: $35

Phone: On my family’s plan still (very blessed).

Costco: P. pays $14.

Amazon Prime: Mooch off a friend (again, very blessed).

iCloud Storage: $0.90

All Other Subscriptions: $0 (purged these once I started to clean up my debt).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, coming from a traditional Asian household, there was always an expectation that I would pursue higher education. My parents did not pressure me to pursue medical school, but there were definitely expectations from my extended family. However, contrary to everyone’s expectations, I chose construction management as my major. During my construction management courses, I was required to take accounting classes and I instantly fell in love. I genuinely enjoyed accounting in school and graduated with an accounting degree. I spent three and a half years in school while also doing summer internships, so I was able to pay for a semester of school; my parents paid for the other three years. I went to the local university and commuted from home in order to save money, but nonetheless, I am fortunate enough to have parents who invested in my education, and I am extremely grateful. I spent about three years working in accounting in many different environments, but none of them made me happy. At my last accounting job, I succumbed to burn out and was incredibly depressed that my career wasn’t “working out”. I decided to quit and take a break. That break ended up lasting three years, but it was well worth it. Now, I’ve pivoted my career to business analytics, and I am enjoying it so far.

Growing up, what kind of conversations did you have about money? Did your parent(s)/guardian(s) educate you about finances?

Growing up, we were always a low-income family. We never took vacations, only ate at home, and the biggest expense was probably the general cost of living. So I was always keenly aware that we had no money. From that, my parents never taught me anything about finances other than “don’t spend money”. I didn’t learn about finances until I had my first office job and was making adult money. I watched a million YouTube videos to learn about personal finance. I would say I have decent knowledge on personal finance, but overall, have nothing to show for it because I blew through my savings during my three-year break, lol.

What was your first job and why did you get it?

I got my first job at 17, against my parents’ will, as a bagger at the local grocery store. My parents were concerned I would lose focus from school if I had a job, but I desperately wanted autonomy from my parents and wanted to make spending decisions on my own that I wouldn’t regret, like treating myself to Starbucks. Granted, I did treat myself out a lot, so I can’t say it wasn’t all regretful. However, working retail from a young age taught me a lot about money and how hard it is to actually make money. I learned that I did not like retail and needed a cushy office job to function. So, by the time I was in college, I spent a lot of time pursuing internships. Luckily, I was able to complete three internships while I was in college which helped me pay for a semester of schooling.

Did you worry about money growing up?

Yes, very much so. I was always aware of how little money we had as a family because my parents always complained about it to us. I don’t believe that’s the best way to raise kids because it puts a lot of pressure on them to essentially find a way to survive at an early age. You start to think as a kid well if I do this, then we can get money or if I don’t do this, then we can save money. It’s a lot to think about at an early age and definitely impacts the way you are once you are older.

Do you worry about money now?

Yes, very much so. I wasn’t worried about it when I was on my three-year break because I was so focused on my mental health and basically surviving that I had to just forgo the thought of money. Of course, that meant I depleted my savings and dove right into credit card debt, but once the anti depressants started working, I was back to my “old” self. I was able to function again and was then concerned about my pressing finances. Luckily, I had nice parents to bail me out, but I am aware that not everyone has that.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself once I moved out of my parents home at 23. At that age, my relationship with my now husband was pretty steady and we both agreed that we needed a space of our own. So without telling my parents, I packed up all my things and left. They were heartbroken and had this expectation that I would essentially live with them forever. But I set that boundary and told them that I needed space to grow. This led to many improvements in my relationship with my parents, and I don’t regret that decision at all. I know there’s always a place I can go back to, but I am also strong enough to stand on my own two feet.

Do you or have you ever received passive or inherited income? If yes, please explain.

No, however, my parents own their home and plan on leaving it to my brother and I once they pass. This will amount to approximately $100,000, which is the closest thing I have to an inheritance. I plan to use most of that money for their funeral expenses and potentially save any remaining. My grandparents on my dad’s side have already passed and they did not leave anything behind. My grandparents on my mother’s side plan to leave everything to my uncle. I am appreciative of anything that I will receive from my parents upon their passing. I don’t expect anything from them because they have helped me so much thus far in life.

Day One: Monday

8 a.m. — I get up and record my daily vlog. (This is something I edit every night and put together to upload onto all my social medias. I realized after a friend moved away that they didn’t really know what was going on in my life on a day-to-day basis, so I started the vlogs as a way to share that. Now, I just enjoy documenting my life. It’s been a joy sharing aspects of my life with my friends and family.) I pop my antidepressants on the way to work. I feel invigorated because it’s the beginning of the week, and the antidepressants are working overtime as I make the 20-minute commute to the office. I’m officially ready to start my week!

8:30 a.m. — I buy some yogurt, pretzels, and hummus as a morning snack from the office cafeteria. This is starting to become a routine thing. $8.10

12 p.m. — I buy lunch at the office cafeteria; Thai curry chicken. It is not very good and I don’t even finish it. Sadness. $14.06

5:30 p.m. — I clock out for the day, record a snip for my vlog, and take the 20-minute drive back home.

6 p.m. — I go to Costco to get my mom a Mother’s Day gift. She said she wanted a gift card to a restaurant from Costco because it was a good value. She’s not wrong: Girl Math is saving $20 from spending $80 to get a $100 gift card. $79.99

6:30 p.m. — Once I’m home, I help my husband P. out by feeding our cat, O. He feeds our dogs, C. and A. I give P. my leftovers from today’s lunch, but he, too, doesn’t like them. We spend the night eating Trader Joe’s frozen foods.

7 p.m. — One of our friends set up a server in a game called Palworld. We spend the rest of the night grinding out some hours in Palworld and just having some fun. I could spend hours talking about games that I play, but for the sake of this activity, I will spare the readers from the boredom and lack of relevance.

11 p.m. — I crawl into bed and unwind with some light reading on my phone. I’m currently reading a Korean novel called Trash of the Count’s Family. It’s in a genre called Izekai, where the main protagonist gets transported into a different world. It’s a fun read, but I quickly knock out.

Daily Total: $102.15

Day Two: Tuesday

8 a.m — I start the day in a similar fashion. I get up, record my daily vlog, and pop my antidepressants on the way to work.

8:30 a.m. — Another day, another morning snack. I grab two kolaches and a muffin from the office cafeteria. I wished they expensed the food here! $7.12

12 p.m. — I plow through my morning meetings and decide that I don’t need lunch today since I had a big breakfast. Grind through lunch.

4:30 p.m. — Finally ready to leave the office; snap a quick video for the vlog, then head out.

5 p.m. — Drive through Raising Canes to pick up food for P., my younger brother, and myself. Not the healthiest, but definitely the weakest hitting on my wallet. $37.31

7 p.m. — We go to the movie theater to watch Sinners with a friend. It’s a great movie with an amazing message on race. I’m in awe of the fun that I had watching the film. Would definitely recommend it to others. P. pays for the movie and movie snacks.

9 p.m. — We go to the local pub right by the movie theater to discuss the film. We chat about life and generally have a good time. P. pays for his drink and our friend’s drink. I don’t drink, so I just opt for some water.

11 p.m. — Wind down with some more Trash then promptly knock out to dream about Sinners.

Daily Total: $44.43

Day Three: Wednesday

9 a.m. — Hurray for hybrid schedules: I get to work from home today, so I wake up and immediately jump into my meetings. They last about two hours.

12 p.m. — I grind through lunch and just power through the rest of the work day. It feels not too bad because I get to hang out with my dogs while I work.

6 p.m. — I drive to the local crane game arcade that just opened up by my place! I’m really excited about this place and have been visiting it weekly for some relaxation. Get some cute trinkets! I’m going to put them on my work desk tomorrow to show off my prized possessions! $34.62

7 p.m. — P. orders dinner for the family — boba and snacks. We really enjoy boba in our household.

11 p.m. — Wind down from the day.

Daily Total: $34.62

Day Four: Thursday

8 a.m. — Back to the office, so back to my regular routine. Wake up, record the vlog, pop the antidepressants, and head out for work.

8:30 a.m. — More yogurt, pretzels, and hummus. As I am filling this out, I am wondering if this is a necessary expense or if I should just wholesale purchase yogurt, pretzels, and hummus. But there is something so nice about not having to think in the mornings. $8.10

12 p.m. — I buy the cheapest thing in the office cafeteria, which is also probably the best thing that they have: chicken tenders and fries. Totally worth it. Had enough to bring home leftovers for P. $9.73

4 p.m. — I leave the office a little early today because I have plans for the night and want to make sure I’m ready to go.

7 p.m. — Go out to eat with a friend at a local sushi spot. My cousin works at the sushi restaurant, so he discounts our meal and gives us extra helpings! So kind of him. I added a high tip, but he refused it 🙁 $41.60

8:30 p.m. — Take my friend to the local crane game arcade! Have to let another person know about my obsession with the place. Win some more cute trinkets and a bag charm to put on my work bag. My desk is probably one of the cutest in the office 🙂 $36.23

10 p.m. — Get home and am tired from spending the long day out. Immediately knock out once I get ready for bed.

Daily Total: $95.66

Day Five: Friday

9 a.m. — Wake up and jump straight into my morning meetings. They end up lasting a little longer than usual, but I don’t mind it because I’m still learning the processes.

11:30 a.m. — Convinced P. to go get a drink and snack with me at our local coffee shop (P. works from home full time, so we get to spend Wednesdays and Fridays working together). We buy two drinks and four pastries. $33.98

5 p.m. — Finish all the remaining work items that I have left and promptly clock out! It feels like a productive week and that I accomplished a lot.

7 p.m. — I do a painting activity called Fluid Bear where you mix paint and pour it onto a plastic bear to create a fluid pattern on it (I booked two classes for P. and me, and paid for them last week). We make the bears as gifts for my niece and nephew and are proud of the results — I would include a photo if I could, they turned out cuter than expected!

8:30 p.m. — We visit the in-laws and have dinner with them. We catch up on our week, how we’ve been since we last saw each other, and anything fun that we have done recently. It’s always nice to see my in-laws; they’re good people and have always been extremely welcoming. We are fortunate enough that both our families currently live in Houston, so we try to visit them on a biweekly basis.

10 p.m. — Go home and wind down from the day. I do a bit of light reading before I fall asleep.

Daily Total: $33.98

Day Six: Saturday

12 p.m. — It’s finally the weekend, so I get to sleep in! I don’t leave the house until noon, when I need to go out to get gas. It kills me, but there’s no way to get around the city other than with a car. It could honestly be worse, so I shouldn’t complain too much. $31.52

1 p.m. — P. and I stop in at a local coffee shop to get some afternoon coffees (he pays). We visit a few boutiques searching for a Mother’s Day gift for my mother-in-law, but we don’t find anything that stands out to us. We stop at a wine bar that’s near one of the boutiques and settle for a bottle of wine as a gift. It’s not an original idea, but it was one of the only things we could agree on. Overall, a pretty successful afternoon.

4 p.m. — I drop P. off at home and get ready for my Bumble BFF date. It’s hard to make friends as an adult, so I joined Bumble BFF to make some friends. Every now and then, this will manifest into an actual meetup, so I get to leave the house and meet with someone and just hang and talk. From the app, I have made at least five friends, so I would say it’s not so bad. It’s definitely still difficult and requires a lot of time and effort, but with enough dedication, you can certainly make friends off the app (this is not a sponsored ad). I will also say, it’s not for everyone.

5 p.m. — I meet my new friend at a ramen shop and we get two bowls of ramen, two appetizers, and two drinks (we split the bill evenly). We chat about ourselves and life in general. My new friend is nice and reminds me greatly of another friend, so much so that I start to miss her, so after dinner, I call said friend and ask, “Are you currently doing anything; can I come over?”, to which she replies with, “Of course!” I am extremely grateful for the people in my life. $35.02

7 p.m. — I meet up with my friend and we yap and yap and yap for about three hours straight. We catch up on life, spill some tea, discuss baby things (she recently gave birth), and share excitement over an upcoming concert that we are going to see. It’s a wonderful night, and I’m glad I’m able to see her.

11 p.m. — Drive through In-N-Out on the way home to grab my brother and me some burgers and animal-style fries (you can never go wrong with animal-style fries). I make it home and instantly knock out after eating. $26.30

Daily Total: $92.84

Day Seven: Sunday

12 p.m. — Sundays are fundays. I get up and buy seven breakfast tacos for myself, P., my friend W., and W.’s sister. Overall, to feed four people with $28 is a steal in this economy. I visit W. first thing in the afternoon and stay with her and her sister just chatting for hours on end. It may seem like I do this a lot, and I would say that I have started to go out more, but I’m making a big effort to keep in touch with my friends, especially since two of my friends moved away to NYC last year. Sometimes, I just feel a little lonely, and other times, it feels like my life is full of social interactions; it’s a balance that I’m learning to make. $28.04

4 p.m. — After we chat for a while, I head home. I have a bit of down time before our dinner plans, so I’m scrolling on the gram when I come across Kurtis Conner’s comedy tour. I buy front-row seats to the show for P. and me. A splurge for sure, but we don’t get to go to shows often, so I feel that it’s pretty worth it. $185.82

5 p.m. — P. and I meet up with some friends for dim sum. He pays for the bill and everyone zelles him for their portion. Everyone is disappointed with how the dim sum tastes, so we decide to grab another bite. We go to a pizza parlor that stays open a little later. We get pizza, root beer, and wings. It’s a wonderful time filled with chatter.

11 p.m. — We don’t get home until late, but it’s well worth it. Afterwards, I sleep off my week of activities.

Daily Total: $213.86

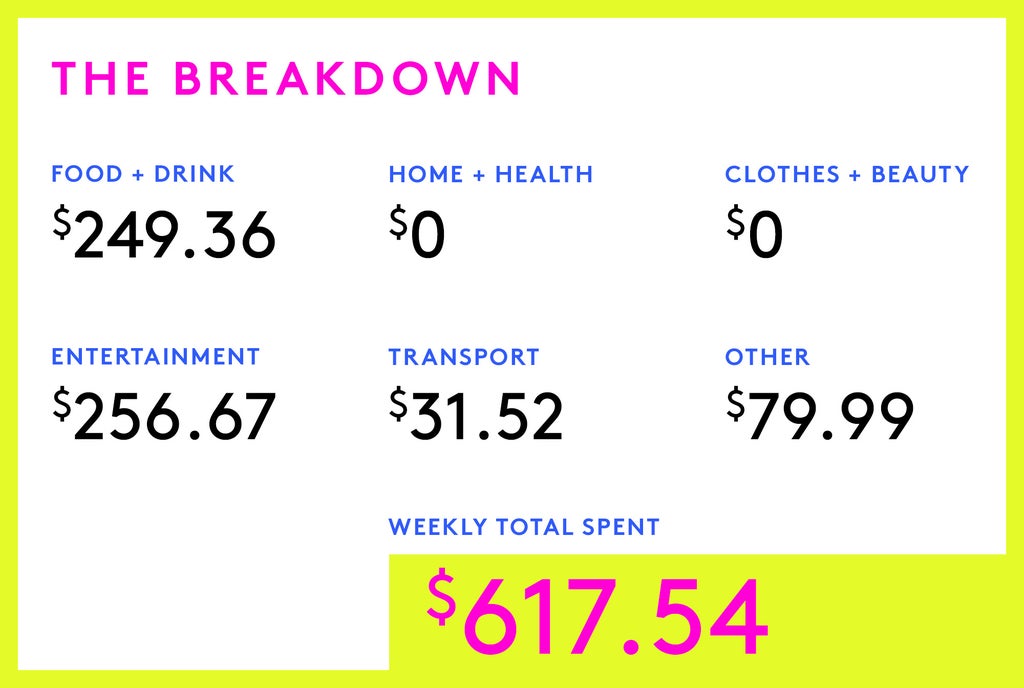

The Breakdown

Conclusion

“It was fun to track my spending during this diary! It also helped that I had recorded daily vlogs, so I could easily remember how certain days went. I have a tendency to forget what I do on a day-to-day basis — this happens because the day seems to go by so fast! There’s so much to do and so much that I am learning, whether it be about work or social life. I think it’s the antidepressants talking, but when I look back on my week, I feel a sense of contentment like I really did enjoy my time. I’m figuring out how to strike a balance between work and life as I navigate working full time again. Overall, I don’t have any regrets with how much I spent over the week. Although, I will be cutting back from eating at the office cafeteria because I have this itching suspicion that the food there is making my skin break out.”

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.

Like what you see? How about some more R29 goodness, right here?

A Week In Hamburg, Germany On $228,942